![[NASA Logo]](../Images/nasaball.gif)

![[NASA Logo]](../Images/nasaball.gif) |

NASA Procedures and Guidelines |

This Document is Obsolete and Is No Longer Used.

|

|

P.1 Purpose

P.2 Applicability

P.3 Authority

P.4 Applicable Documents and Forms

P.5 Measurement/Verification

P.6 Cancellation

1.1 Overview

1.2 Roles and Responsibilities

2.1 Overview

2.2 Agreement Financial Documentation

2.3 Financial Business Rules

2.4 Budget and Execution

3.1 Overview

3.2 Agreement Cost and Rates

3.3 Calculation of Agreement Full Cost

4.1 Overview

4.2 Pricing Methodologies

4.3 Pricing Adjustments

4.4 Considerations for Pricing Reimbursable Work

This National Aeronautics and Space Administration (NASA) Procedural Requirement (NPR) provides the financial management requirements for partnership agreements (agreements) where NASA is the seller or performing organization. Financial management requirements include the establishment and update of policy, required reviews and approvals, application of proper pricing and costing, and entering accounting transactions.

a. This NPR is applicable to NASA Headquarters and NASA Centers, including Component Facilities and Technical and Service Support Centers. This language applies to Jet Propulsion Laboratory (JPL) (a Federally-Funded Research Development Center (FFRDC)), other contractors, recipients of grants, cooperative agreements, or parties to agreements only to the extent specified or referenced in the appropriate partnership agreements.

b. These requirements are applicable to agreements and the financial-related activities performed by NASA under authorities granted in the National Aeronautics and Space Act, 51 U.S.C. § 20101 et seq. (Space Act) and other laws, such as the Economy Act, 31 U.S.C. § 1535.

c. In this NPR, the term “agreement” is used to denote reimbursable and nonreimbursable, domestic, international, and other Federal agreements. The term “agreement” does not refer to:

(1) Contracts, grants, or cooperative agreements as defined in 31 U.S.C. ch. 63, Using Procurement Contracts and Grant and Cooperative Agreements.

(2) NASA working capital fund orders (refer to NPR 9095.1, Working Capital Fund Policies and Requirements).

(3) Non-agreement or nonbinding arrangement as defined in NAII 1050-1, Space Act Agreements Guide (type of agreement that does not require financial management activity).

(4) Funded agreements as defined in NASA Policy Directive (NPD) 1050.1, Authority to Enter into Space Act Agreements (executed in accordance with NPD 1000.5, Policy for NASA Acquisition).

(5) Agreements where NASA is the requesting agency or buyer.

d. In this NPR, the term “Center Chief Financial Officer (Center CFO)” is used to denote NASA Center Chief Financial Officers and equivalent positions in the Mission Support Directorate (MSD) Resource Performance Management Office (RPMO) and the NASA Management Office (NMO) organizations. The term “Center Office of Chief Financial Officer (OCFO)” is used to denote those offices under the Center CFO with responsibilities for performing financial activity.

e. In this NPR, all mandatory actions (i.e., requirements) are denoted by statements containing the term “shall.” The terms “may” denotes a discretionary privilege or permission, “can” denotes statements of possibility or capability, “should” denotes a good practice and is recommended, but not required, “will” denotes expected outcome, and “are/is” denotes descriptive material.

f. This directive is not intended to replace other financial policy or non-financial policy and processes applicable to agreements. Further agreement policy and procedures should be reviewed in conjunction with this directive, such as, NPD 1050.1, NAII 1050-1, Space Act Agreements Guide, NAII 1050-3, Partnerships Guide, NPD 1360.2, Initiation and Development of International Cooperation in Space and Aeronautics Programs, NPD 8800.14, Policy for Real Estate Management, and NPR 8800.15, Real Estate Management Program. In addition to P.3 and P.4, refer to Appendix G References.

g. In this NPR, all document citations are assumed to be the latest version unless otherwise noted.

a. Government Employees Training Act (GETA), 5 U.S.C. § 4103.

b. Quarters and Facilities; Employees in the United States, 5 U.S.C. § 5911.

c. Chief Financial Officers Act of 1990, 31 U.S.C. §§ 901-903.

d. Application of Appropriations, 31 U.S.C. §1301(a).

e. Antideficiency Act (ADA), 31 U.S.C. §§ 1341-1342, 1517.

f. Money and Finance, 31 U.S.C. §§ 1501-1502.

g. Prohibited Obligations and Expenditures, 31 U.S.C. § 1517.

h. Economy Act, 31 U.S.C. § 1535.

i. Custodians of Money, 31 U.S.C. § 3302.

j. Title V of the Independent Offices Appropriations Act of 1952, Fees and Charges for Government Services and Things of Value, 31 U.S.C. § 9701.

k. National Aeronautics and Space Act, 51 U.S.C. § 20101 et seq.

l. Lease of Non-Excess Property, 51 U.S.C. § 20145.

m. Deposit of Proceeds, 51 U.S.C. § 20145 Note.

n. Enhanced Use Lease (EUL), 51 U.S.C. § 31505.

o. Commercial Space Launch Act, as amended (CSLA), 51 U.S.C. § 50913.

p. Land Remote Sensing Policy, 51 U.S.C. § 60113.

q. National Historic Preservation Act, 54 U.S.C. § 306121.

r. NPD 1050.1, Authority to Enter into Space Act Agreements.

s. NPD 1050.2, Authority to Enter into Cooperative Research and Development Agreements.

t. NPD 1360.2, Initiation and Development of International Cooperation in Space and Aeronautics Programs.

u. NPD 1370.1, Reimbursable Utilization of NASA Facilities by Foreign Entities and Foreign-Sponsored Research.

v. NPD 9010.2, Financial Management.

a. NASA Transition Authorization Act of 2017, Pub. L. 115–10, title VIII, § 841, Mar. 21, 2017, 131 Stat. 72.

b. Office of Management and Budget (OMB) Circular A-11, Preparation, Submission and Execution of the Budget.

c. OMB Circular A-25, User Charges.

d. NPR 9220.1, Journal Voucher Preparation and Approval and Intragovernmental Transactions.

e. NPR 9420.1, Budget Formulation.

f. NPR 9610.1, Accounts Receivable, Billing, and Collection.

g. NASA Interim Directive (NID) 8800.114, National Historic Preservation Act (NHPA) Leases.

h. NID 9091.1, Real Property Out-Grant Agreements - Financial Requirements.

i. NAII 1050-1, Space Act Agreements Guide.

j. NAII 1050-3, Partnerships Guide.

k. Federal Accounting Standards Advisory Board (FASAB) Statement of Federal Financial Accounting Standards (SFFAS) 4: Managerial Cost Accounting Standards and Concepts.

l. SFFAS 7: Accounting for Revenue and Other Financing Sources and Concepts for Reconciling Budgetary and Financial Accounting.

m. Treasury Financial Manual (TFM), Volume 1, Part 2, Chapter 4700, Agency Reporting Requirements for the Financial Report of the United States Government, Appendix 6, Intragovernmental Transaction (IGT) Guide.

Quality assurance reviews and analysis of financial and budgetary reports and data submitted through the continuous monitoring program will be used to measure compliance with this NPR.

NPR 9090.1A, Reimbursable Agreements, dated February 25, 2013.

1.1.1 This directive establishes financial requirements for agreements as related to the financial management and administrative procedures, such as determining the estimated partner price (based on full cost), monitoring and recording agreement execution, and reporting agreement activity.

1.1.2 Agreements are generally referred to as reimbursable and nonreimbursable. Definitions and additional information are provided in NPD 1050.1 and its implementing instructions. 1

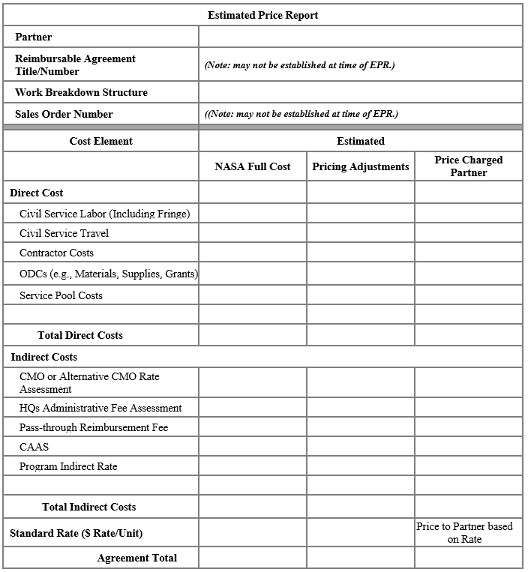

a. Reimbursable agreements require an estimated price report (EPR) unless listed as an exception in section 1.1.4. Reimbursable agreements may be executed as a fully reimbursable agreement or a reimbursable agreement with a price adjustment.

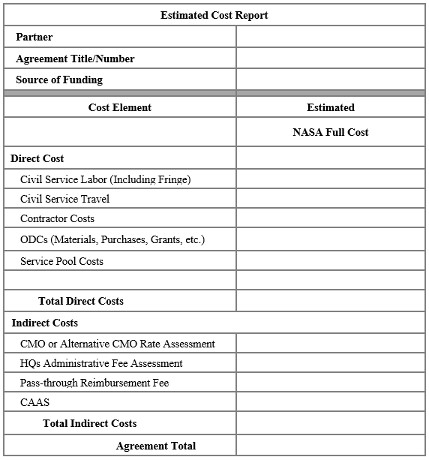

b. Nonreimbursable agreements require an estimated cost report (ECR) 2 unless listed as an exception section 1.1.4.

1.1.3 Agreements require development of an EPR or ECR (EPR/ECR) that is reviewed and approved by the Center CFO. Refer to Appendix C Estimated Price Report and Estimated Cost Report Templates.

a. An EPR is the supporting financial document for a reimbursable agreement that identifies NASA’s estimated resources (cost), any pricing adjustments, and estimated price to the partner for work to be performed by NASA as defined in an agreement.

b. An ECR is the supporting financial document for a nonreimbursable agreement that identifies NASA’s estimated costs and funding source for the work to be performed by NASA as defined in the agreement. The ECR is generated with sufficient detail to align the activity with the appropriate budget item(s).

c. The Center CFO approved EPR/ECR is provided as supporting documentation for the Signing Official in their consideration and determination of whether the balance of the contribution under the Agreement is fair and reasonable compared to NASA resources to be committed, NASA program risks, and corresponding benefits to NASA.

d. The EPR/ECR is an internal NASA planning document used to estimate the services to be provided to the partner. It is not a part of the agreement and should not be provided to the partner. The summary level information may be shared with the partner, where requested by the partner and deemed appropriate given the situation, to the extent that it doesn’t include proprietary data and has been vetted through the Center CFO. Calculations or specific identification to contracts or contractor information should not be provided to the partner. Any summary financial information provided to the partner will include a disclaimer that the information is for planning purpose only, and the estimated amount due from the partner will be based on the final cost of the services provided through the agreement.

1.1.4 Exceptions to the EPR and ECR requirement for agreements are:

a. Travel-only agreements.

b. Assignment of personnel agreements, e.g., Intergovernmental Personnel Act (IPA), 5 U.S.C. §§ 3371-3375, assignments; Intergovernmental Personnel Program (IPP) assignments, 42 U.S.C. ch. 62; Visiting Researcher assignments.

c. Use of personal and real property permits that are loans of property and are zero dollars or contain a gratuitous amount. 3

d. International nonreimbursable agreements with non-private sector partners.

e. Reciprocal aid agreements where NASA and an external organization mutually agree to assist during emergency situations (e.g., 42 U.S.C. § 1856a).

1.1.5 For financial purposes, the types of agreements are: a standalone, an umbrella (with annex(s)), an annex under an umbrella, or an amendment. Regardless of whether executed as reimbursable or nonreimbursable, each requires either an EPR/ECR unless an exception exists per 1.1.4.

a. A standalone provides the legal framework for NASA and a partner to execute a single or specific activity. The activity may be performed by one or multiple Centers. Where more than one Center is involved, refer to section 2.3.3.2.

b. An umbrella provides a mechanism for NASA and a partner to approve and perform a series of related or phased activities using a single governing instrument that contains all common terms and conditions. The umbrella establishes the legal framework for accompanying annexes. Individual tasks are implemented through the annexes which adopt the terms and conditions of the umbrella and include specific details for each task. Refer to NAII 1050-1 for further definition of an umbrella agreement. Each such annex requires an individual EPR/ECR as each is executed and may not exceed the term of the umbrella.

c. An amendment provides for the modification of an agreement, an umbrella, or an annex. An amendment that changes the estimated full cost or the price to the partner requires an EPR/ECR for the amount of the amendment. An amended EPR/ECR has the same vetting and approval requirements as the initial document.

1.1.6 NASA may execute agreements under several statutory authorities. Consult with the Agency Office of General Counsel (OGC)/Center Office of Chief Counsel (OCC) for appropriate authority when performing activities with a partner or for assistance where questions arise. The authority cited may impact NASA’s ability to retain reimbursement and proceeds. Refer to Appendix D Authorities for some commonly used authorities.

1.1.7 In addition to the activity and the authority, the partner is also a consideration for financial purposes when developing the agreement. The partner, whether Federal, non-federal, etc., may impact how funding is received, recorded, and reported in NASA financial accounts and statements.

1.2.1 The Agency Chief Financial Officer (CFO) or Agency Office of the Chief Financial Officer (OCFO) Division designee shall:

a. Develop, update, and issue financial management policies for agreements and interpret laws and other guidance for application.

b. Perform accounting and financial management and reporting related to agreements, such as:

(1) Maintain financial records and prepare internal and external reports.

(2) Request and receive apportionments of reimbursable authority from the OMB and distribute authority to Centers.

(3) Provide oversight of internal controls, including those to prevent over-obligation of reimbursable funds.

(4) Establish conventions for accounting classifications supporting reimbursable work (e.g., Work Breakdown Structure (WBS) codes) in accordance with NASA policy.

c. Review agreement abstracts or proposed agreements, in accordance with Agency policy, and provide comments or concurrence. 4

d. Review and approve cost waiver requests for reimbursable agreements in which the estimated price to the partner is less than the estimated direct cost of the activity. Provide disapproved cost waivers and reasoning to the Center CFO. Revised cost waivers may be resubmitted for reconsideration.

1.2.2 Agency Associate Administrators for the Mission Directorates, Officials-in-Charge of Headquarters (HQs) Offices, NASA Center Directors, and the Director, NMO, or their designees, within their areas of jurisdiction, shall:

a. Develop budget estimates in conjunction with Agency OCFO for reimbursable activity based on budget requests and guidance.

b. Manage negotiation, approvals, and execution of agreements as outlined in NASA policy and guidance, such as NPD 1050.1 and its implementing instructions.

c. Ensure an approved EPR/ECR and required waivers or pricing adjustment justifications are included with an agreement as supporting documentation prior to final agreement signature.

d. Monitor the financial status of reimbursable agreements, internal controls, and other actions to ensure NASA receives the proper level of reimbursement for work performed by NASA.

1.2.3 The Associate Administrator for the Office of International and Interagency Relations (OIIR) or their designee shall implement their responsibilities, as outlined in NPD 1050.1 and its implementing instructions and this NPR. Responsibilities include the negotiation, conclusion, amendment, and termination of international agreements; the review of agreements with other Federal Agencies; and the review, coordination, and archiving of classified interagency activities.

1.2.4 Center CFO and equivalent positions in the MSD RPMO and the Director, NMO, or their designee (Center CFO), shall:

a. Ensure the overall accounting and financial management of agreements is in accordance with this NPR and other relevant financial policy and procedures.

b. Review and approve Center agreements as part of the overall approval process.

c. Review and approve EPRs/ECRs for Center-related activity on agreements prior to final agreement approval, to include the amount, funding source, and purpose. 5

d. Review and approve applicable waivers (such as cost waivers, other pricing adjustments, or waivers of advance payment) and ensure the appropriate approvals have been obtained for the direct funding source.

e. Review and approve Center-specific or alternative indirect cost rates in accordance with section 3.2 Agreement Cost and Rates.

1.2.5 Center Office of Chief Financial Officer (Center OCFO) and equivalent offices at HQs shall:

a. Perform the accounting and financial management of agreements is in accordance with this NPR and other relevant financial policy and procedures.

b. Prepare an agreement-level EPR/ECR when designated as the responsible or managing (lead) Center of a multi-Center agreement, i.e., other Centers are designated for a portion of the work. (Refer to section 2.3.3.2.)

c. Ensure a market survey is provided when Center reimbursable work is comparable to a market equivalent and that the results of the survey are consolidated, evaluated, and analyzed, with the objective of reaching a pricing structure for the Center. Refer to Appendix E Market-Based Pricing.

d. Monitor agreement execution in coordination with the Agreement Managers and the performing organization to ensure financial issues are managed and resolved, e.g., low funding notification, expiration notification.

e. Reconcile reimbursable agreement financial records and disposition the related funding.

f. Notify the NASA Shared Services Center (NSSC) of refunds or bill of collections.

1.2.6 The NSSC shall:

a. Receive advances and notify the responsible Center OCFO for proper posting.

b. Execute monthly billings and collections.

c. Process refunds or bill of collections.

1.2.7 Agreement Managers shall:

a. Ensure approved EPR/ECR and supporting documentation are included in the agreement routing package and uploaded to the official agreement system of record.

b. Administer agreements, in coordination with the Center OCFO and the performing organization, to include notifying the Center OCFO of issues that may impact the financial management of an agreement.

1.2.8 The performing organization, 6 in coordination with the Agreement Manager and supporting Center OCFO, staff shall:

a. Ensure agreement routing package contains financial information, such as:

(1) Approved EPR/ECR, for the agreement, including the identification of a direct funding source and justification for pricing adjustments. (Refer to section 2.3.3.2.)

(2) Center CFO-approved waiver of advance payment (based upon need).

b. Monitor the financial activity and internal controls, in coordination with the Center OCFO, to ensure partners are properly charged for reimbursable activities and costs do not exceed the obligation when conditions necessitate finance action such as a change in price (increase or decrease) or termination of work.

c. Develop budget estimates in conjunction with Center OCFO for reimbursable activity in accordance with budget request and guidance.

d. Ensure reimbursable work is not initiated until an agreement is fully executed and advance funds are received, unless a waiver for advance payment is approved.

1.2.9 The Center OCC and/or the Agency OGC shall review, provide legal guidance, and comment/concur on agreements in accordance with applicable fiscal and financial laws, regulations, and NASA policies.

2.1.1 This chapter establishes the financial and related administrative requirements of agreements, such as the financial content, business rules, and EPR/ECR requirements, which are conducted to ensure agreements are properly executed, recorded, and reported. Minimum agreement activity content and clauses are established in NPD 1050.1 and its implementing instructions.

2.1.2 A full-cost EPR/ECR is required for agreements unless listed as an exception in section 1.1.4. Further guidance for EPRs/ECRs is contained in section 2.3 Financial Business Rules; templates for EPRs/ECRs are contained in Appendix C.

2.1.3 In addition to the requirements in this NPR for out-grant of real property, refer to NID 9091.1, Real Property Out-Grant Agreements - Financial Requirements, for additional financial requirements and NPD 8800.14 and NPR 8800.15 for policy and procedures related to property management. Service agreements to out-grant of real property, such as demand services, would be completed under this NPR.

2.2.1 The financial documentation of an agreement includes the information necessary to support the financial aspects of the agreement. The minimum financial documentation includes:

a. Legal authority applicable to the agreement, i.e., the authority that allows NASA to perform the work. Refer to Appendix D for some commonly used authorities and costing or pricing impacts.

b. Partner and name of partner. When citing a Federal agency, the name of the organization and the overall Agency should be provided.

c. Period of performance and, if relevant, interim financial milestones.

d. Partner finance or payment office, phone number, and address, as appropriate.

e. Approved EPR/ECR supporting the agreement, including, as appropriate, descriptions of significant cost elements and rate(s), indirect costs (e.g., Center Management and Operations (CMO) rate, HQs Administration Fee Rate), estimated full cost of the agreement, the estimated price to the partner, pricing adjustments, and the cost, if any, to be borne by NASA. Refer to section 2.3 for EPR requirements.

(1) An appropriate sponsoring direct fund will be identified for agreements. 7

(2) When a pricing adjustment is identified or the agreement is nonreimbursable, the program/project office absorbing the related estimated costs (sponsoring organization) shall concur on the EPR/ECR prior to submission for Center CFO final review and approval.

(3) When the performing office is not the same as the sponsoring organization, the sponsoring organization shall provide concurrence on the EPR/ECR prior to submission to the Center CFO for final review and approval.

(4) Other financial-related documentation used to support the EPR/ECR, such as a cost analysis or market survey, is included.

f. Center CFO-approved waiver of advance payment, if applicable.

g. Funding documents (Federal only) or advance payment. 8

h. For Federal partners, funding documents will include the prescribed accounting elements for proper recording and financial reporting as determined by the Center OCFO in accordance with the Department of Treasury guidelines for interagency transactions, e.g., Treasury Financial Manual (TFM), Volume 1, Part 2, Chapter 4700, Agency Reporting Requirements for the Financial Report of the United States Government, Appendix 6, Intragovernmental Transaction (IGT) Guide.

2.3.1 This section provides an overview of the business rules applicable to agreements. Section 2.4 Budget and Execution provides additional policy and guidelines on the financial aspects of administering partnership agreements such as budget and execution. Basic agreement business rules are:

a. An agreement will be supported by an approved EPR/ECR unless an exception exists per section 1.1.4. The respective Center OCFO should be contacted during the initial phases of an agreement discussion. 9

b. Each annex will be treated as a separate agreement only for the EPR/ECR purposes of costing, pricing, billing, and/or collection. 10

c. An agreement amendment that changes the estimated full cost or the price to the partner requires an approved EPR/ECR for the amount of the amendment, unless an exception exists per section 1.1.4.

2.3.2 Request for services or performance of work (commitments and obligations) may commence under an agreement when the following conditions have been met:

a. The Center CFO or designee has approved the EPR/ECR.

b. The agreement has been executed, i.e., signed approval by authorized representatives of both NASA and the partner.

c. When a reimbursable agreement, the reimbursable funding has been received by the performing Center, i.e., full or partial advance payment received and recorded for a non-federal partner or funding document provided by a Federal partner. As authorized in NPD 1050.1, exceptions to this rule that allows for direct funds to be used are in section 2.3.7.

d. For nonreimbursable agreements, the authorization of work and availability of resources follows the normal NASA financial processes.

2.3.3 The EPR will contain NASA’s estimated full cost of the agreement, any proposed pricing adjustment, the estimated price charged to the partner, justification for any proposed pricing adjustment, approval by the sponsoring organization with identified direct fund, and final approval by the Center CFO.

2.3.3.1 Proposed pricing adjustments, to include waived and excluded cost, will be identified in the price adjustment column on the EPR. The EPR may be used as the official approval document for a cost waiver request or other pricing adjustment. Refer to Chapter 3 Full Cost of Agreements, Chapter 4 Reimbursable Agreement Pricing, and Appendix C for additional guidance.

a. When the final estimated price to the partner is less than the estimated direct cost to NASA, the EPR will be submitted to the Agency CFO for approval prior to final approval of the agreement.

b. Justifications for waived cost will identify the program/project fund for the waived cost and demonstrate a quantifiable benefit to NASA that may be used by the Signing Official in their consideration for approval.

c. Justification for other pricing adjustments will identify the program/project fund for the absorbed costs, the statutory laws and regulations or allowable market-based pricing methodologies, and other details to support the adjustment (section 4.3).

2.3.3.2 An agreement-level EPR/ECR is required for a multi-Center standalone agreement or annex. The agreement-level EPR/ECR represents NASA’s estimated full cost of the agreement, including the other performing Center’s estimated full cost. The other Centers may submit an approved EPR/ECR to the lead Center; or the other Centers may provide their estimated full cost to be included in the agreement level EPR/ECR for their approval.

a. During the planning stages of the agreement, the proposing organization shall determine whether other Centers might perform some of the work.

b. The proposing organization shall identify the managing (lead) Center OCFO to the performing Centers and identify any proposed pricing adjustments, e.g., reduced or an alternative CMO rate, cost wavier. Generally, the lead Center OCFO is aligned to the Center with overall responsibility for execution of the agreement.

c. The proposing organization should identify, discuss, and obtain concurrence from the performing Centers for proposed pricing adjustments. This pre-negotiation ensures an undue financial burden is not placed on the performing Centers.

d. The performing Center shall prepare and approve an EPR/ECR for their portion of the work and associated pricing adjustment for inclusion in the agreement-level EPR/ECR or provide the information to be included in the overall agreement EPR/ECR for their approval. Pricing adjustments will be approved in accordance with the guidance in section 1.2 Roles and Responsibilities.

e. The lead Center shall prepare and approve an agreement-level EPR/ECR that includes the estimated prices for the other performing Centers as confirmation that the individual EPRs/ECRs total to the estimated amount for the agreement. The approval of the agreement-level EPRs/ECRs from the lead Center CFO does not represent approval for the other Center CFO.

f. Where a proposing organization later identifies another Center as a performing Center, the performing Center should prepare an EPR/ECR to support their work and the lead Center OCFO should initiate the Center-to-Center transfer.

2.3.4 The ECR will contain the estimated full cost of the agreement, justification for the performance of the nonreimbursable work, approval by the sponsoring organization with identified direct fund, and final approval by the Center CFO.

2.3.5 Agreement activity will be executed in accordance with current financial guidance, including:

a. An understanding that cost estimates placed in an agreement are for planning purposes and are not a guarantee of the final price for services (as outlined in the agreement).

b. Services should not be performed beyond the available advance funding amount from the non-federal partner or in excess of the funding amount received from a Federal partner. The Agreement Manager and the project office are responsible for ensuring work is stopped until sufficient funding is made available based upon receipt of additional funding.

(1) If the service costs more than the advance funding amount, the funding document amount, or the amount identified in an advance payment waiver, the partner will be advised by NASA as soon as possible. Additional funding from the partner or an approved revised advance payment waiver will be received to continue work.

(2) If the partner is not able or willing to provide additional funding, work should cease and a determination made on whether to cancel the remaining effort and/or terminate the agreement.

c. For other Federal agreement activity, specific financial business rules may apply. The following are a few examples of specific business rules:

(1) Intragovernmental Transaction. Intragovernmental transaction and reconciliation requirements will be followed in accordance with the Department of Treasury guidelines for inter-agency transactions and NPR 9220.1, Journal Voucher Preparation and Approval and Intragovernmental Transactions.

(2) Economy Act Authority. The Economy Act places a limitation on the funding received by the performing agency (seller). Under 31 U.S.C. § 1535(d), the requesting agency (buyer) is required to deobligate their funds at the end of the period of availability to the extent that the seller (NASA) has not incurred an obligation for a bona fide need within the period of availability. Funds are no longer available to incur new obligations by NASA once the requesting agency’s funds have expired. 11

(3) Other Authority. Where other than the Economy Act is cited as the statutory authority in the agreement, the deobligation requirement typically does not apply. The recording of the obligation is governed by 31 U.S.C. § 1501(a)(1). The obligation of funds to the performing agency (seller) is complete upon execution of the agreement and remains payable in full. 12 However, non-Economy Act transactions are still subject to the requirements of the bona fide needs rule and other restrictions in the authority cited.

(4) Interagency Acquisitions and Prompt Payment Act Interest. Per Office of Federal Procurement Policy (OFPP-OMB) memorandum, “Improving the Management and Use of Interagency Acquisitions,” dated June 2008, the requesting partner is responsible for interest owed under the Prompt Payment Act, except when the delay to the contractor is created by NASA. For delays created by NASA, the Prompt Pay interest will be absorbed by the NASA direct funding source rather than billed to the reimbursable partner.

d. Measures will be taken to mitigate the possibility of an Antideficiency Act (ADA), 31 U.S.C. §§ 1341-1342, purpose violation, such as by ensuring reimbursable work is consistent with NASA’s mission and the underlying appropriation for the organization performing the activity. When a potential ADA has been identified, the Center OCFO in consultation with the Center OCC will analyze the situation to determine if a deficiency exists. The Agency OCFO will be notified when a potential violation has been detected. Refer to NPR 9050.3, The Antideficiency Act.

e. Center OCFOs should make every effort to have partners submit advances and payments electronically. The available electronic payment methods and guidance are published on the Treasury’s Bureau of Fiscal Service (BFS) Web site. Center OCFOs may contact the NSSC for questions on payment methods, to include Federal Reserve Wire Network (Fedwire), Society for Worldwide Interbank Financial Telecommunication (SWIFT), Automated Clearing House (ACH), and Electronic Funds Transfer (EFT). NPR 9630.1, Accounts Payable and Disbursements, also provides limited information on electronic methods.

2.3.6 Internal controls will be used to monitor the financial execution of reimbursable agreement, such as performing the control activates outlined in the Agency OCFO Continuous Monitoring Program. As outlined in section 1.2, all levels involved in agreements, including management, project managers, technical point of contacts, and financial personnel, share this responsibility.

2.3.7 In the absence of a signed agreement, an advance, or distribution of reimbursable budget authority, direct funding sources should not be used to finance work in connection with a reimbursable project, unless all of the following criteria are met:

a. An EPR, including any pricing adjustments and justification, has been approved by the Center CFO and the responsible organization providing the direct funding.

b. The scope of the work has been determined to be time-sensitive and mission critical. This determination will be approved by the Center CFO in consultation with the Agency OGC or Center OCC, the related NASA Mission Directorate, and the Office of International and Interagency Relations (OIIR) when agreements involve interagency or international partners. The determination and combined approvals acknowledge the following:

(1) The scope of the work is consistent with the purpose of direct funding being used.

(2) The direct funds are available and sufficient without impacting other NASA programs.

(3) The recognition that reimbursement received may not be available to replenish the direct funds. The reimbursable authority may not be available if the agreement is not executed in the same fiscal year as the work performed.

2.3.8 Financial Disputes with a Non-Federal Partner. Financial or funding disputes that cannot be resolved by the responsible organization or Center CFO should be discussed with the Center OCC for disposition.

a. If it is determined that NASA has a legal claim to recover additional reimbursement from a partner, debt collection procedures in accordance with NPR 9610.1, Accounts Receivable, Billing, and Collection, will be followed.

b. If it is determined that NASA does not have a legal claim to recover additional reimbursement from a partner or a reimbursable authority is not available for the fiscal year covering the uncollected reimbursement, the unreimbursed expenditure of appropriated funds should be reviewed by the Center CFO in consultation with the Center OCC. The unreimbursed expenditure will be reviewed to determine whether use of such funds meets requirements relating to the purpose and period of availability of the charged appropriation for the work performed to determine if a deficiency situation exists.

2.3.9 Financial Disputes with a Federal Partner. Financial or funding disputes that cannot be resolved by the responsible organization or Center CFO should be resolved through the process outlined in the Department of Treasury guidelines for inter-agency transactions.

2.3.10 When acquisition of property, plant, and equipment (PP&E) or capital improvements to existing NASA PP&E would be an appropriate action as part of the agreement, refer to NPR 9250.1, Property, Plant, and Equipment and Operating Materials and Supplies, for guidance.

2.4.1 Anticipated Reimbursable Authority. Reimbursable budget authority is the authority to enter into reimbursable agreements with other entities and accept funding from them as reimbursement for the cost of services rendered or goods provided. It is an integral part of being able to enter into a reimbursable agreement and is provided by OMB incident to the Agency’s request in the President’s annual budget. Reimbursable agreements bring in funding resources that are in addition to the direct authority granted in the appropriation bills. Acceptance of outside funding without proper budget authority is considered augmentation and is a violation of appropriation law principals. NASA may not perform reimbursable work where budget authority has not been granted and apportioned. Refer to OMB Circular A-11, Preparation, Submission and Execution of the Budget, for requirements related to the budget and execution of reimbursable agreement activity.

a. Agency anticipated reimbursable budget authority is requested and submitted according to the planning, programming, budgeting, and execution (PPBE) cycle outlined in NPR 9420.1, Budget Formulation. The PPBE cycle includes instructions and requirements related to reimbursable agreements, e.g., anticipated budget authority.

b. Center OCFOs will complete and submit the request in accordance with the requirements. Once anticipated reimbursable budget authority has been approved and apportioned, the Agency OCFO shall distribute anticipated reimbursable budget authority to the Centers.

c. Center OCFOs are responsible for monitoring available anticipated reimbursable budget authority and notifying the Agency OCFO when a proposed reimbursable agreement may exceed the existing authority. When anticipated reimbursable budget authority is not available, the Center OCFO shall request the additional anticipated reimbursable budget authority in accordance with Agency guidance.

2.4.2 Agreement Routing and Approvals. Center CFOs shall review Center agreements and approve the related EPRs/ECRs prior to final agreement and execution by the Signing Official. Responsibilities include:

a. Review the EPR/ECR for the estimated cost and/or price to the partners, verify justifications provided for pricing adjustments, and ensure a direct funding source is identified for pricing adjustments or nonreimbursable activity and applicable approvals are received. The Center OCFO shall confirm the direct funding and the concurrence by the performing and/or sponsoring organization prior to approval. Waived costs in which the price charged to the partner is less than the direct cost of the activity will be submitted to the Agency OCFO for final approval. If a cost waiver is disapproved by the Agency OCFO, Center CFOs may resubmit with additional information or revisions.

b. Review and approve requests for waivers of advance payment from a non-Federal partner. Requests for advance payment waivers require identification of a valid program direct funding source. The direct funding source provides assurance for availability of funds in case a reimbursement is not realized from the reimbursable partner. Advance payment waivers will be maintained as part of the supporting documentation for the agreement.

2.4.3 Reimbursable Agreement Execution. The Center OCFOs shall:

a. Ensure financial records and reports are maintained at the agreement level to facilitate financial management.

b. Review cited authority to ensure costs and any surplus proceeds (i.e., amounts in excess of the full cost of providing work) are recorded in accordance with the authority. 13 Retention of surplus proceeds is allowed when permitted by the statutory authority cited in the agreement; otherwise, the amounts will be deposited into Treasury’s Miscellaneous Receipts account.

c. Ensure each reimbursable agreement is assigned a WBS(s). Each reimbursable agreement will be assigned a project WBS(s) for program/project identification.

d. Record advances received from partners based on notification from the NSSC in accordance with NPR 9610.1.

(1) Advances received for a valid agreement will be credited as Advances from Others to the NASA appropriation used in execution of the work with proper reference to the relevant reimbursable agreement.

(2) Advances received from a partner that cannot be properly associated to an agreement will be returned to the partner.

e. Recognize available budget against the anticipated reimbursable authority when an advance, a funding document, or an approved waiver of advance is received against a reimbursable agreement.

(1) Available budget will be available to incur obligations after the reimbursable agreement is executed (signed) as long as the agreement activity is within the period of performance and the partner’s funds remain available (if the partner is another Federal agency).

(2) Available budget associated with a particular reimbursable agreement is not available for performing work on a different agreement unless a transfer has been approved by the partner and available budget has been recognized against the other agreement.

f. Ensure obligations and costs related to a reimbursable agreement are charged to the proper reimbursable funding and correct WBS(s).

2.4.4 Revenue Recognition. Direct and indirect costs will be recognized as earned revenue as the reimbursable services are performed in accordance with SFFAS 7, Accounting for Revenue and Other Financing Sources and Concepts for Reconciling Budgetary and Financial Accounting. Per SFFAS 7, “earned” or “exchange” revenues are recognized when a Government entity provides goods and services to the public or to another Government entity for a price.

2.4.5 Billing and Collections. The billing and collection cycle is important in the financial execution of a reimbursable agreement to ensure costs incurred by NASA are properly recorded, billed, and reimbursed by the partner, i.e., offset against an advance or payment by the partner. The monthly billing cycle is required regardless of an advance being received.

a. Bills will reflect cost incurred in support of the work associated with the agreement as recorded by the Center and should include a percentage of the indirect cost.

b. The NSSC will process and send monthly bills to reimbursable partners unless the agreement specifies a different cycle (e.g., quarterly) or the Center OCFO requests a different cycle.

(1) For agreements with advances, bills will be recorded against the advance received in accordance with accounting transaction guidance.

(2) For agreements without advances, bills are provided based on cost incurred or as specified in the agreement.

(3) Bills will contain the agreement reference number, period of performance, and other cost or data detail per the agreement.

c. The Center OCFO, in collaboration with the NSSC, may submit a deferred billing request to the Agency OCFO Financial Management Division (FMD) Director when the amount billed is less than the periodic billing cost and additional costs are expected to be incurred for the activity. When a deferred billing has been approved, Center OCFOs will provide for the timely recognition of revenue. Per NPR 9610.1, billing and collection procedures should include periodic comparisons of costs incurred and amounts collected in order to determine cost-effective dollar thresholds at which to process interim reimbursable billings.

(1) A reimbursable billing may not be deferred when:

(a) Costs are considered final and the activity is near completion.

(b) Work has been suspended and no additional costs are expected to be incurred to support the activity.

(2) An amount remaining unbilled would be brought forward in the next billing cycle as a beginning unbilled balance when billings have been deferred.

d. Billings for reimbursable agreements that are negotiated by NASA HQs will be validated by the performing Center OCFO or the designated lead Center OCFO for a multi-Center agreement. 14

(1) For a single-Center agreement, the performing Center OCFO is generally designated to manage the agreement and shall use their current procedures for cost and billing (as if the agreement were a Center-negotiated agreement).

(2) For a multi-Center agreement, the HQs office that negotiated the agreement is responsible for identifying a lead Center OCFO and providing the participating Centers copies of the agreement and other applicable supplemental data. Although the lead Center OCFO is responsible for monitoring the overall costing and billing status of the agreement, each participating Center OCFO is issued specific reimbursable authority and is responsible for recording cost and overseeing the billing related to their activity.

e. NASA Center project and program staff share responsibility with the Center OCFO for monitoring the performance and billed cost to reimbursable partners and shall account for reimbursable costs that are not billed. Personnel knowledgeable in resource utilization of the project will review cost and billings for accuracy. Corrections or adjustments should be recorded within 30 calendar days of verification. If possible, corrections will be accomplished within the same accounting period as that in which discrepancies were identified. Corrections and adjustments will be associated with the accounting periods in which the corrections were recorded.

2.4.6 Agreement Reporting.

a. The standard financial reporting cycles, to include billings, are completed at the end of the month, although quarterly status reports and billing may be designated. Center OCFOs are responsible for confirming the interim or final financial status reporting to partners is in agreement with and supported by accounting data. The partner is responsible for specifying content and frequency that deviates from the standard reports. However, demands for financial status reports or billings that would require special or system changes will not be accepted. The Center CFO has responsibility to determine whether a special request is acceptable.

b. The Center OCFO will coordinate or assist in coordination for obtaining other external reporting requirements that require validation of financial-related data, e.g., NASA Transition Authorization Act of 2017, Pub. L. 115–10, title VIII, § 841, Mar. 21, 2017, 131 Stat. 72.

2.4.7 Agreement Reconciliation and Completion.

2.4.7.1 A financial reconciliation will be performed and a bill or refund will be submitted to the partner as specified in the agreement and in accordance with Agency guidance.

a. If NASA’s costs exceed the funding received, a bill of collection will be processed, unless specifically waived by the Center CFO, i.e., the amounts owed are inconsequential and the cost to collect payment will exceed the amount owed.

b. If NASA’s costs are less the funding received, the excess funds will be returned to the partner or deposited to Treasury Miscellaneous Receipts Account.

(1) A refund of an advance payment in excess of $100,000 will be approved by the Center CFO or their designee.

(2) For non-federal partners, a refund will be made through EFT methods in accordance with Treasury regulation 31 CFR pt. 208, unless an authorized waiver is recognized per 31 CFR § 208.4.

(3) For Federal partners, a funding reduction will be processed against the funding document(s). However, if an advance was received, a refund will be issued through the Treasury payment and collection system.

2.4.7.2 To minimize excessive refunds or additional billings, every effort will be made to ensure that costs and cost adjustments are recorded in a timely manner.

2.4.7.3 A claim for reimbursement to recover partner reimbursable costs that have been incurred by NASA and which cannot be offset against a cash advance can be considered reimbursable debt. If reimbursable debts remain outstanding from partners, debt collection efforts are to be pursued. If reimbursable debts to recover costs incurred on behalf of the non-federal partner are determined to be uncollectible, they may not be written off. An alternative source of funding will be identified to cover costs that have been incurred.

3.1.1 Estimating NASA’s full cost is required for both reimbursable and nonreimbursable agreements and is the initial step or baseline, unless an exception exists per section 1.1.4. The determination of NASA’s estimated full cost to execute an activity in a reimbursable agreement is instrumental in ensuring we receive adequate compensation for performing a service or providing a good to a partner that is not a direct benefit to NASA. Just as important is estimating NASA’s full cost for nonreimbursable activity to determine whether the balance of the agreement’s contributions are fair and reasonable compared to the NASA resources to be committed, the NASA program risks, and corresponding benefits to NASA. The EPR/ECR template in Appendix C should be used to calculate NASA’s full-cost estimate.

a. Assignment of full cost to a reimbursable agreement activity is not necessarily equivalent to the estimated price. The estimated full cost describes NASA’s estimated cost, as outlined below, while price represents the estimated amount NASA charges the partner. The difference between full cost and price may be determined by the benefit received through issuance of waived cost, statutory-directed excluded cost, or other authorized pricing adjustments. This chapter provides policies for the determination and assignment of full cost to an agreement. Chapter 4 discusses the policies for pricing an agreement.

b. In developing a method for estimating costs for nonreimbursable agreements, NASA’s estimated full cost contribution should be calculated in the same manner as a reimbursable agreement, i.e., in enough detail for the Signing Official to determine whether the balance of the partner contribution is fair and reasonable compared to the NASA resources to be committed, NASA program risks, and corresponding benefits to NASA. 15

3.1.2 Recognizing that the computation of estimated full cost is not an exact science, NASA strives to ensure the costing methodology used is supportable, repeatable, and defensible and follows the general accepted accounting principles established in the FASAB Standards and Other Pronouncements, as amended. In accordance with SFFAS 4, Managerial Cost Accounting Standards and Concepts, the estimated full cost of an activity is calculated by adding the estimated costs of the resources to be used by the performing organization, (direct and indirect contribution) and the identifiable supporting services provided by other organizations. These costs should be assigned through a supportable costing methodology or cost finding technique most appropriate to the activity (output) and should be followed consistently.

3.1.3 In developing a method for estimating the cost of work on an agreement, both direct and indirect costs contributing to the output will be considered regardless of the funding sources. The full cost of the agreement should only include work that is specific to the partner for the scope of work identified in the agreement. The order of preference for assigning these costs is:

a. Directly trace costs wherever feasible and economically practicable.

b. Assign costs on a cause-and-effect basis.

c. Allocate costs on a reasonable and consistent basis.

3.2.1 Full Cost. As established in section 3.1, the full-cost estimate is the baseline for an agreement and includes the proposed direct and indirect resources to provide goods or services (output) based on the agreement requirements.

3.2.1.1 Direct Costs. Direct costs represent those costs that can be directly traced to an output (of the reimbursable activity) and should be individually identified and applied to the reimbursable project. Typical direct costs in the production of an output include:

a. Salaries and other benefits for employees who work directly on the output.

b. Travel costs to support specific work identified in the agreement.

c. Materials and supplies used in the work.

d. Service pool labor and materials that will be directly charged to an agreement.

e. Contract cost, e.g., labor, materials, supplies, that are directly associated with the responsibilities in the agreement.

f. Various costs associated with office space, equipment, facilities, and utilities that are used exclusively to produce the output.

g. Costs of goods or services received from other segments or entities that are used to produce the output.

h. Other direct costs (ODCs) related to the production of the output.

3.2.1.2 Indirect Costs. Indirect costs represent resources that are jointly or commonly used to produce two or more types of outputs, but are not specifically traceable to one output. Typical examples include costs of administrative services, general research and technical support, security, rent, employee health, and operating and maintenance costs for buildings and equipment, etc. If these costs cannot be assigned to outputs on a cause-and-effect basis in an economically feasible manner, the costs may be applied through reasonable allocations.

3.2.2 Indirect costs may be calculated as a percentage of the direct cost using a predetermined authorized rate for the supporting management and other administrative expenses. The type of rate, the percentage used for the rate, and amount associated with the rate should be included as a separate line on the EPR/ECR.

3.2.3 Authorized indirect rates include: Center Management Operations (CMO), HQs Administrative Fee, Contract Administration and Audit Services (CAAS), Center Pass-Through, and authorized alternative CMO rates in accordance with section 3.2.4. Indirect rates and supporting documentation will be made available to the Agency OCFO and Center OCFOs.

a. The Center OCFO may use the authorized indirect rate in effect at the time the agreement is signed for the life of the agreement or five years, whichever is shorter. This may be applied to a multi-year agreement or an annex for an umbrella agreement. An indirect rate for longer than five years may be applied when the agreement is submitted for official Agency review and approved in the EPR/ECR.

b. Alternatively, the Center OCFO may use the annual authorized indirect rate for the out-year calculations of indirect cost for an agreement or an annex of an umbrella agreement. Fluctuations in price due to rate changes may be identified through the estimated price in the agreement.

3.2.3.1 Agency Center Management Operations (CMO) Rate. The standard authorized CMO rate is representative of a Center’s indirect cost associated with an agreement based on the overall CMO budget. 16 Annually, the Agency OCFO Budget Division will calculate and distribute the CMO rate to the Center CFOs. The annual CMO rate should be used by Center OCFOs, except for agreements managed by MSD RPMO (activity performed by HQs organizations) or the NMO (activity performed by JPL) as outlined in section 3.2.3.2. A Center CFO may approve an alternative CMO rate in accordance with section 3.2.4.

3.2.3.2 HQs Administrative Fee Rates (for MSD RPMO and NMO). Similar to the CMO rate, the administrative fee rate is calculated annually to recover the indirect cost associated with the management of the agreement by MSD RPMO and NMO for work by HQs and JPL. For HQs initiated agreements where work is performed and managed by a Center, the annual CMO rate should be used for calculating the indirect costs rather than the HQs Administrative Fee.

3.2.3.3 Pass-Through Fee Rate. The pass-through fee rate represents an administrative charge to cover the cost associated with agreements that identify existing contract(s) through which work will be completed and for which NASA does not directly provide the product, service, or use of facilities. The pass-through fee is charged in place of the CMO rate, except as noted in section 3.2.3.3c. A pass-through agreement allows the partner to obtain services from a NASA contract as a convenience to the partner, e.g., utility services. Cost components for calculating the pass-through reimbursement fee may include the Office of Procurement, OCFO, Center OCC, Partnership Office, Center Director Office, and other participating organizations.

a. The Center CFO is responsible for approving the pass-through fee rate calculated annually. The pass-through fee rate should be consistent throughout the year unless there is a substantial change to the cost components that requires the fee to be recalculated.

b. General criteria for determining whether an agreement may be considered for use of the pass-through rate includes:

(1) Work may be performed using an existing contract or a contract action (e.g., task order) that does not require special terms or a modification to the scope. An example is a contract action where the reimbursable partner has developed the technical content and NASA is executing the contract action.

(2) Work may be performed with minimal technical oversight or direction by NASA. Accordingly, a contract would not include a Statement of Work tailored for this agreement to meet the requirements of the partner. Limited and insignificant participation by NASA is allowable to provide for normal contract management, monitoring of contract performance, and financial management responsibilities.

(3) Work may be performed without the use of NASA facilities or other resources. Limited and insignificant participation by NASA is allowable to provide for normal contract management, monitoring of contract performance, and financial management responsibilities.

c. An exception to the pass-through rate charged in place of the CMO rate is where it may be more appropriate to apply both rates. This exception is identified when a significant portion of the agreement (i.e., 50 percent of the total direct costs) is considered a pass-through activity with a portion of the work performed by NASA; the pass-through is distinguished by a separate task or similar breakout; and each portion of the agreement could be subject to an applicable rate. For identified exceptions, the pass-through rate and other identified rate will be displayed as separate line items on the EPR/ECR and associated cost identified to the rate.

3.2.3.4 Contract Administration and Audit Services (CAAS) Rate. The CAAS rate is assessed for the cost associated with administering procurement services, used in completing the reimbursable activity, that are subject to audit requirements and exceed $1 million. CAAS charges are applicable to the pass-through procurement actions meeting this criteria. The Agency Office of Procurement sets and manages the standard CAAS rate for these services. The CAAS rate in effect at the time the agreement is signed will be used to determine the applicable CAAS cost and will be identified as a separate indirect cost line item on the EPR/ECR.

3.2.4 A Center OCFO may propose an alternative CMO rate or a program may request a program indirect rate. The Center CFO is responsible for approving these rates. Once a rate is approved by the Center CFO, it is considered an authorized indirect rate.

3.2.4.1 Authorized Alternative CMO Rate. An authorized alternative CMO rate represents a Center indirect rate for a specified agreement activity that varies from the annual CMO rate. For example, although the agreement is a large dollar amount, the related indirect cost is not proportionate; it maybe lower than the annual CMO rate.

a. At a minimum, the Center OCFO will document the purpose of the alternative CMO rate, the basis of the calculation/methodology, and the application of the rate.

(1) Authorized alternative CMO rates should be reflected in the CMO rate line of the EPR/ECR or a separate designated line. The rate should not be reflected as a pricing adjustment.

(2) An alternative CMO rate that is not approved by the Center CFO may be submitted as a price adjustment for the variance amount and is subject to Center CFO approval on the EPR.

b. An alternative CMO rate will be agreed to by the performing Center CFOs in accordance with section 2.3.3.2 (multi-Center EPR/ECR approval process) prior to being approved by the proposing Center CFO.

c. An authorized alternative CMO rate may not be applied to other agreements unless approved as part of the request, regardless of the partner or activity.

d. An authorized alternative CMO rate and supporting documentation will be provided to the Agency OCFO.

3.2.4.2 Program Indirect Rate. A program indirect rate represents the indirect costs specific to a program that are not part of the CMO rate.

a. At a minimum, the program will document the purpose of the rate, the basis of the calculation/methodology, and the application of the rate. The cost elements for the program indirect rate will not overlap the cost elements identified as part of the CMO rate.

b. The rate is in addition to a CMO or alternative CMO rate and would be identified as a separate line item on the EPR/ECR.

3.3.1 For purposes of agreement work, the estimated full cost of an agreement refers to the calculated direct and indirect costs, as described in the above sections, for NASA to perform the specified work. NASA’s policy is to apply standard rates based on experience or similar work, whenever possible, to calculate the estimated full cost of the agreement activity.

3.3.1.1 Standard Rate Agreement Cost. A standard rate ($/unit) or charge based on consumption or other quantifiable measure and should be applied when there is recurrent demand for the same or similar goods or services and actual costs for those goods or services are not expected to fluctuate significantly. The overall project management should develop a standard rate by using a costing methodology that is both consistent and supportable. Examples of when standard rates may be appropriate are wind tunnels, vacuum chambers, flight simulators, and other similar facilities where a daily/hourly rate may be calculated.

a. Standard rates should include indirect administrative and operations costs as outlined in section 3.2.1.2.

b. Standard rates will be periodically reviewed and evaluated to ensure the standard rates are reflective of NASA’s full costs. Such reviews will be performed on a biennial basis, at a minimum.

c. Standard rates developed for overall use by a program affecting more than one Center should be developed by the responsible program, board, or oversight office, in coordination with the Agency OCFO and Center OCFO. The rates will be reviewed for whether the methodology is supportable, may be applied on a consistent basis, and conforms to appropriation law. Although the calculated standard rate may not be the same for similar facilities at different Centers, the methodology used in calculating the rate should be performed in a similar manner.

d. Standard rates developed for Center-only use should be developed by the responsible program or oversight office in coordination with the Center OCFO. The rates will be reviewed for whether the methodology is supportable, may be applied on a consistent basis, and conforms to appropriation law.

3.3.1.2 Agreement Cost. When the full cost of an agreement project cannot be estimated using standard rates or charges, Centers shall estimate the full cost by projecting resources to be consumed by the agreement project and costs of those resources. NASA Centers will conduct an analysis to identify each cost element involved and how to assign the cost to the project.

4.1.1 NASA provides reimbursable support to other Federal/governmental agencies, commercial sector entities, educational entities, and foreign entities under various legal authorities in a wide range of agreement activity. Several authorities contain conditions and requirements for reimbursable activity and the allowance for other than full-cost reimbursement. Because of these specific conditions and allowances, NASA considers the authority for the reimbursable agreement in the price charged to the partner along with the cost.

4.1.2 Cost and price are sometimes used interchangeably or calculated using the same methodology; however, as discussed above, they are not the same. The authority, the agreement activity, and the partner will be considered when determining the appropriate pricing methodology. NASA’s estimated full cost discussed in Chapter 3 is the baseline and starting point for both reimbursable and nonreimbursable agreements and should be calculated using the EPR/ECR template in Appendix C. For reimbursable agreements, adjustments are then included for waived costs (benefits received by NASA), excluded costs, or other authorized pricing adjustments (e.g., market-based pricing variation), to arrive at the estimated price charged the partner.

4.1.3 Current recognized pricing methodologies are standard rate based, cost based, and market-based pricing, as discussed in the following sections.

4.2.1 Standard Rate Pricing. Just as a standard rate ($/unit) or charge is used for estimating the full cost of an agreement activity, the same standard rate calculation would be used for pricing the activity in an EPR. Refer to section 3.3.1.1 for additional information on standard rate development. The estimated full cost based on a standard rate may be adjusted through pricing adjustments in accordance with this NPR to determine the estimated price to the partner. Adjustments will be properly identified and justified in the EPR.

4.2.2 Cost-Based Pricing. Cost-based pricing is applied in accordance with the agreement costing estimate calculation outlined in sections 3.2 and 3.3.1.2. The agreement’s estimated cost may be adjusted through pricing adjustments in accordance with this NPR to determine the estimated price to the partner. Adjustments will be properly identified and justified in the EPR.

4.2.3 Market-Based Pricing. Per OMB A-25, User Charges, “market price means the price for a good, resource, or service that is based on competition in open markets, and creates neither a shortage nor a surplus of the good, resource, or service.” Market-based rates are based on the fair market value. Rates will be established through an annual (or as required) survey and should avoid putting outside commercial providers at a competitive disadvantage, i.e., price should be adjusted to similar prices charged “outside the gate.” Refer also to NPD 9080.1.

4.2.3.1 Market-based pricing is required in the out-granting of real property and EUL arrangements. Exceptions are where the pricing requirements for specific services or facilities are established by statutory authority or where the agreement activity to be performed by NASA does not have a comparable fair market value equivalent on which to base the rates.

4.2.3.2 Market-based pricing requires establishing the full cost of the agreement activity and adjusting (upward or downward) to achieve the market price to the partner. Centers should consult with their Center OCFO and Center OCC to ensure adherence to other NASA policy provisions. Refer to Appendix E. Market-Based Pricing and OMB Circular A-94, Guidelines and Discount Rates for Benefit-Cost Analysis of Federal Programs.

a. Where a contemplated market price is higher than the full cost of the work, the ability to charge will not conflict with other legal or policy restrictions, e.g., Economy Act agreements are limited to actual or full cost pricing. Retention of proceeds is limited to the statutory authority cited in the agreement (section 2.4.3b).

b. Where a contemplated market price is lower than full cost, the following should be considered in the determination:

(1) The real property, other assets, or services are underutilized and available.

(2) The full cost is inconsistent with local market conditions.

(3) The revenue derived would offset some or most of the current budget requirement for maintenance and disposition.

(4) The price should be at or above the marginal cost of providing the good or service.

4.2.3.3 The Center OCFO will ensure a market survey is provided when Center reimbursable work is comparable to a market equivalent and the results of the survey are consolidated, evaluated, and analyzed, with the objective of reaching a pricing structure for the Center. The pricing structure will be:

a. Supported by the survey results.

b. Comparable to prices that partners could expect to find at other commercial providers, given any discount or premium that is applied to compensate for bona-fide differences.

c. Rational, fair, and consistently applied.

4.2.3.4 Where commercial service providers are unwilling to share pricing information or the Center is unable to compile enough information to develop a market survey, the information should be documented and an alternative pricing methodology used.

4.3.1 Waived Cost. Waived costs represent costs that are estimated to be incurred by NASA to perform work associated with a reimbursable agreement, but are not charged to the partner because of the benefit received by NASA. Estimated waived costs are identified a pricing adjustment column on the EPR. Centers should only consider waived cost requests where there is a clear and demonstrated NASA benefit. Consideration should be based on whether the office absorbing the costs is willing to fund the waived costs based on the benefits derived from the effort if the reimbursable agreement were not being executed. As described in section 2.2.1e, the sponsoring organization providing an alternative source of direct funding for waived costs shall also provide concurrence when different than the performing office.

a. Benefits derived will be directly related to NASA’s mission/program/projects and, to the extent practicable, quantifiable. Cost waivers may not be based on intangible benefits, such as goodwill, community relations, or philanthropic reasons.

b. Benefits may be established based on the performing and/or sponsoring organizations identifying how the work would benefit NASA. A few examples of programmatic benefits include agreements involving activities directly related to NASA’s strategic education goals, development or testing where the resultant product or data has value to NASA’s mission, and work products (e.g., test data) that are made available to NASA. Although not as common, cost waivers may also be developed related to institutional resources.

c. Where direct costs are waived, the indirect cost may be waived in proportion to the reduction. Along with justification, the direct and indirect waived costs will be identified as separate pricing adjustments on the EPR.

d. The Center CFO is responsible for final approval of requested waived costs up to the indirect cost amount. When the estimated price to the partner is less than the direct cost to NASA, the Agency CFO will also review and approve the EPR. (See section 1.2.)

4.3.2 Other Authorized Pricing Adjustments. Other authorized pricing adjustments will be based on laws, regulations, policy, or allowable market-based pricing methodologies. When authorized pricing adjustments are used, performing organizations need to recognize that the estimated full cost is not recovered and their direct funds are used. Examples of authorized pricing adjustments currently used by NASA are excluded costs, market-based pricing, and Tracking and Data Relay Satellite System (TDRSS), 14 CFR pt. 1215.

4.3.2.1 Excluded Costs. Excluded costs represent estimated costs that are not chargeable [price] to a partner due to laws, regulations, or official agency requests per NPD 9080.1. Budget submission justifications and requests do not represent OMB approval unless they are expressly outlined and understood to be requests for approval of less than full cost. 17 Excluded costs are identified in the price adjustment column of the EPR. CSLA is an example of statutory exclusion for certain cost in calculating the price to a partner.

4.3.2.2 Market-Based Pricing. Market-based pricing may result in net proceeds or loss to NASA. For real property out-grants, market-based pricing generally results in the price exceeding the estimated cost (upward price adjustment) as most of NASA’s real property has been fully depreciated. For goods or services that are calculated at full cost, the market price may identify a loss (a downward price adjustment) to NASA. The amount collected above full cost may only be retained as allowed by statutory authority; otherwise, they are deposited into the Treasury’s Miscellaneous Receipt Account. Market-based adjustments are identified in the price adjustment column of the EPR.

4.3.2.3 TDRSS Pricing. 14 CFR pt. 1215, establishes considerations to be used in pricing TDRSS charges for non-U.S. government entities. TDRSS pricing adjustments are identified in the price adjustment column of the EPR.

4.4.1 Considerations for Pricing Federal Reimbursable Agreements. Law prohibits an agency from deriving profit, augmenting its appropriations, or using another agency’s funds for purposes other than for which the funds were originally appropriated.

4.4.1.1 Economy Act. The Economy Act provides authority for Federal agencies to engage in interagency reimbursable activity under certain circumstances. The EPR, estimated cost and price, is based on full-cost principles to reasonably reflect the actual cost of the work for the Federal partner as required by the Economy Act.

4.4.1.2 Other Authorities. The Center should consult their Center OCC and Agency OIIR for other authorities that may be used in lieu of the Economy Act, such as the Space Act or GETA authorities when the activity may warrant a nonreimbursable agreement. As outlined in prior sections, the standards and process for determining waived costs and other pricing adjustments will be followed when evaluating the activity and reflecting price adjustments on the EPR.

4.4.2 Considerations for Pricing CSLA Agreements. Refer to Appendix F. Commercial Space Launch Act Agreement Pricing. To determine applicability of CSLA, consult with Agency OGC/Center OCC and the Center CFO. Where CSLA is used for out-grant of real property, refer also to NID 9091.1. Indirect cost are identified as excluded cost in a pricing adjustment column of the EPR and are subject to Center CFO approval. Costs not charged the partner for more than the estimated indirect cost are subject to the Agency OCFO approval.

4.4.3 Considerations for Pricing Out-Grant of Real Property Agreements. The pricing methodology and related pricing adjustments will be based on the authority under which the agreement is executed. Refer to NID 9091.1.

4.4.4 Considerations for Pricing Rental Quarters and Related Facilities. Refer to NID 9091.1.

Commercial. As defined in the National Space Policy of the United States of America (June 28, 2010), “The term ‘commercial’ for purposes of this policy, refers to space goods, services, or activities provided by private sector enterprises that bear a reasonable portion of the investment risk and responsibility for the activity, operate in accordance with typical market-based incentives for controlling cost and optimizing return on investment, and have the legal capacity to offer these goods or services to existing or potential nongovernmental customers.”

Commercial Launch or Reentry. The means to place or try to place a launch vehicle or reentry vehicle and any payload or human being from Earth in a suborbital trajectory (from a launch site in the United States); in Earth orbit in outer space; or otherwise in outer space; or to return or attempt to return purposefully, a reentry vehicle and its payload or human beings, if any, from Earth orbit or from outer space to Earth.

Commercial Launch or Reentry Efforts. The activities supporting the commercial launch or reentry of a suborbital or space vehicle, payload, crew (including crew training), government astronaut, or space flight participant. Activities may include, but are not limited to, development of a vehicle or a payload for flight, and associated ground safety; engineering activities; acceptance of a vehicle or a payload (or their components) by the provider, associated handling, transportation, and storage; processing a vehicle, a payload, or support for crew and spaceflight participants (including training) for launch or reentry; integrating a launch vehicle and a payload; activities at a launch or reentry site; and conducting a launch or reentry.

Cost Element. The categorical subdivisions of direct and indirect costs used in estimating NASA resources for an agreement activity. Examples of categorized cost elements are civil service labor, civil service travel, contractor costs, costs associated with office space or facilities, and utilities used to support the activity.

Cost Estimate. The calculation of NASA’s planned commitment of resources to perform an activity outlined in an agreement. Costs should be identified by direct and indirect cost elements and in enough detail that reviewing and approving officials are aware of and agree to the resources being used to perform the activity.

Direct Cost. The cost that can be specifically identified with an output. All direct costs should be included in the full cost of outputs. Typical direct costs in the production of an output include: (a) salaries and other benefits for employees who work directly on the output; (b) materials and supplies used in the work; (c) various costs associated with office space, equipment, facilities, and utilities that are used exclusively to produce the output; (d) costs of goods or services received from other segments or entities that are used to produce the output; and (e) other costs related to the production of the output (e.g., travel).

Domestic Partner. A non-government U.S. entity.

Estimated Cost Report. The supporting financial document generally used to capture NASA’s estimated costs and funding source for work to be performed by NASA as defined in a nonreimbursable agreement. The template in Appendix C outlines the minimum requirements for an ECR.

Estimated Price Report. The supporting financial document used to capture NASA’s estimated costs, pricing adjustments, and estimated price to the partner for work to be performed by NASA as defined in a reimbursable agreement. The template in Appendix C outlines the minimum requirements for an EPR.

Excluded Costs. The costs not charged a partner in accordance with statute (e.g., CSLA, other laws) or regulatory policy (e.g., request to Congress, per NPD 9080.1).