Procedural

Requirements

Effective Date: September 30, 2008

Expiration Date: September 30, 2024

|

NASA Procedural Requirements |

NPR 9095.1 Effective Date: September 30, 2008 Expiration Date: September 30, 2024 |

| | TOC | ChangeHistory | Preface | Chapter1 | Chapter2 | Chapter3 | AppendixA | AppendixB | AppendixC | ALL | |

C.1.1 Use of the National Aeronautics and Space Administration (NASA) Working Capital Fund (WCF) presents organizations with the ability to finance operations in a manner consistent with commercial best practices. It allows flexibility in operational planning, procurement, and customer relationship management. However, before an organization converts its funding source from appropriated to working capital funds, it must ensure business viability and prepare for the transition to the WCF. This appendix provides a framework for candidate organizations to perform financial and operational analysis and to develop the required business case analysis document.

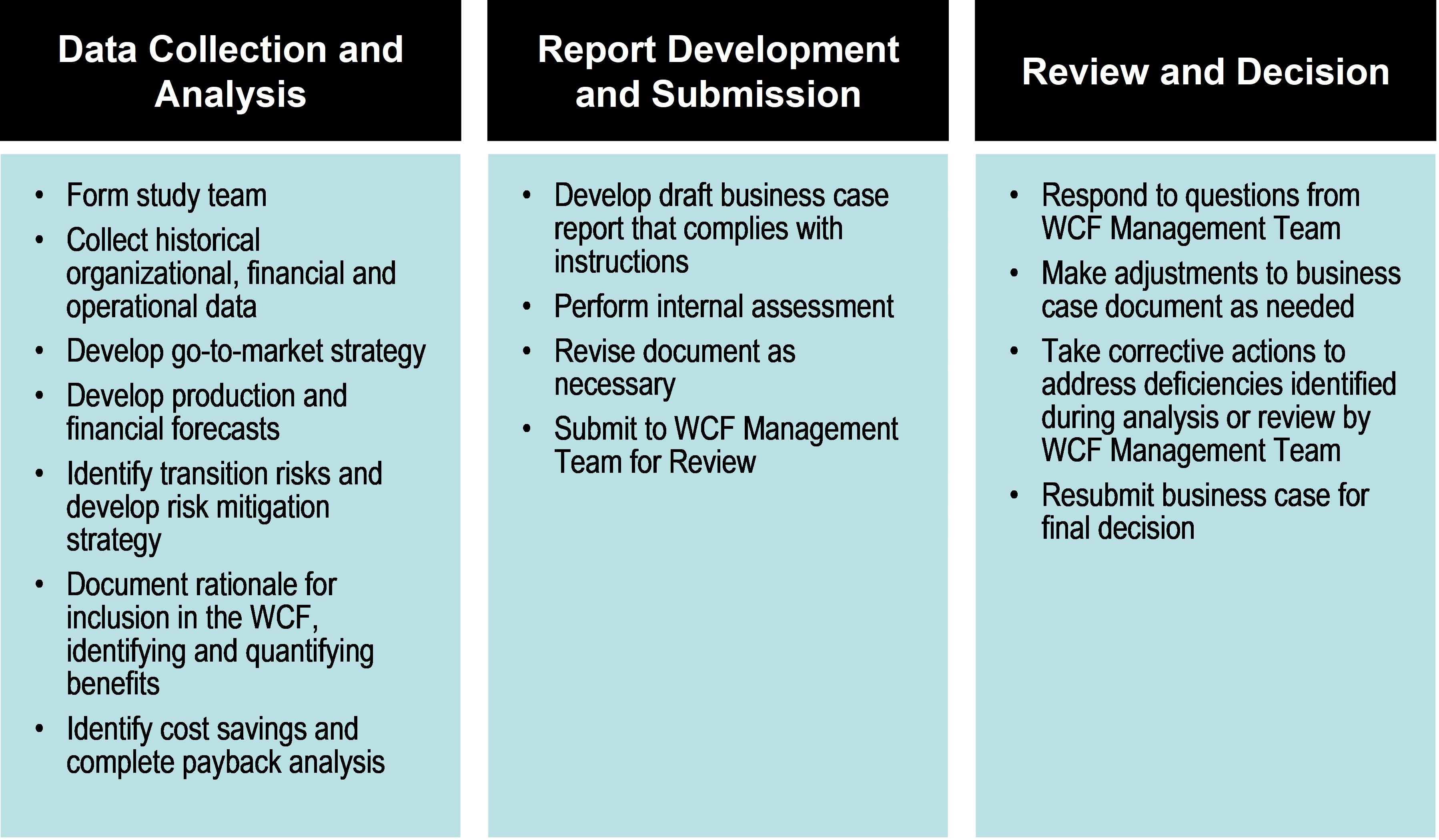

Figure B-1, Business Case Process

C.2.1 All WCF candidate organizations as well as existing WCF business entities that seek to add a new line of business, are required to develop a business case that complies with these instructions as part of the evaluation process. These instructions apply to all applicants applying for inclusion in the NASA WCF.

C.3.1 The Business Case Serves Two Primary Roles:

a. Ensures candidate organizations understand and can quantify both the risks and benefits associated with transitioning to the NASA WCF.

b. Provides the NASA WCF managers with sufficient information to make an appropriate decision on whether the candidate should ultimately be included in the WCF.

C.3.2 In completing the business case, it is helpful to think of the candidate organization as a private company (one whose financial goal is to break even over time rather than make a profit) seeking investment funding. The business case should provide sufficient information to allow a third party to decide whether or not to invest funds in the venture.

This section presents a recommended process for developing, reviewing, and submitting the business case. As shown in the figure below, the process is composed of three phases:

C.4.1 Data Collection and Analysis.

C.4.1.1 During the first phase of business case development, the candidate organization's leadership must appoint a study team that will be responsible for all facets of business case development. The team will be the focal point for all matters related to collecting background data, performing financial and operational analysis, developing the report, and responding to questions from the WCF Management Team. The team will spend a large portion of time assembling or generating historical organizational, financial, and operational data that describes the past performance of the candidate organization. This material may include:

a. Strategic plans.

b. Staffing plans.

c. Financial statements.

d. Accounting reports.

e. Organizational mission/charters.

f. Cost reports.

g. Production statistics.

h. Market analysis.

i. Budget data.

j. Process flow charts.

C.4.1.2 One thing to consider during this collection process is the ready availability of the data. Much of this data will be needed to perform the day-to-day management of the organization once admitted to the WCF. If the data is unavailable, unreliable, or difficult to collect, the study team should include a plan to improve these conditions as part of the business case.

C.4.1.3 The team will develop a "go-to-market" strategy that will address how the organization will identify and service customers, what its growth strategy is, and how it will compete with other available alternatives. This strategy will include an assessment of the competitive environment of the goods and services the organization provides (or plans to provide). The strategy should also include any plans to expand the business after admission to the WCF, along with a rationale for making the change.

C.4.1.4 The team must also develop production and financial forecasts to assess the demand for the organization's goods and services. This assessment should take into account the market environment and competitive forces and their impact on future sales.

C.4.1.5 Any organizational change involves some degree of risk. Transiting into the WCF generally carries financial and operational risk. The study team must identify transition risks and develop a risk mitigation strategy to address each risk area.

C.4.1.6 Finally, the team must define and quantify the value proposition for transitioning the organization into the WCF. Specifically, describe the reasons why the organization should transition, including anticipated cost savings and payback.

C.4.2 Report Development and Submission. Once the team has completed the necessary analysis, it must prepare the business case document, complying with these instructions. Once the document has been drafted, NASA Headquarters functional proponent should review it to ensure its completeness and that it adequately substantiates a value proposition as a viable WCF candidate. It is critical that the candidate's leadership is in total agreement with the business case and supportive of the analysis. Upon completion of recommended revisions and program manager approval, the final document should be forwarded to the NASA Office of the Chief Financial Officer for review and comment.

C.4.3 Review and Decision. In the final phase of the development process, the candidate's leadership and project team should be available to respond to questions from the WCF Management Team. They may be required to formally present the business case. They may also be required to make adjustments to the business case document as needed and take corrective actions to address deficiencies identified during analysis or review by WCF Management Team. If necessary, they will resubmit the business case for final decision.

C.5.1 This process requires significant time and resource commitment, it is important that a candidate perform adequate due diligence prior to admission to the WCF to avoid financial or operational problems.

C.6.1 The format and content of the business case document is intended to be flexible to allow for the wide variety of organizations that will apply for inclusion in the WCF, as well as allow for creativity on the part of the candidate organizations. However, all business case documents must contain a common core analysis.

C.6.2 Required Sections. The following sections must be included in all business case submissions. While the section itself is required, the scope and depth of content are largely at the discretion of the candidate organization. It is important that the business case contain a complete and accurate picture of the rationale and supporting data for transferring the organization into the WCF. Therefore, the candidate's study team should make the most compelling case possible.

C.6.2.1 Purpose. This section serves as an introduction for the entire business case document. It should include a purpose statement and summary of the document.

C.6.2.2 Organizational Description. This section should include an in-depth description of the candidate organization. It should include the organization's mission, structure, and a description of the goods and services the organization provides. It should also include a description of operating locations and facilities, as well as, features of the organization and operation that are unique from other government or competitive organizations. It should also include any pertinent statutory requirements that impact operations or that mandate a transition to the WCF.

C.6.2.3 Competitive Environment. This section should include a thorough assessment of the organization's competitive environment for the goods and services it provides. If there are no commercial or government alternatives, state so. This section should include not only competitive prices, but also a characterization of the marketplace including how customers make buying decisions, typical order sizes, and factors impacting competitive advantage. Furthermore, this section should include a go-to-market strategy that addresses how the organization identifies and services customers, what its growth strategy is, and how it will compete with other available alternatives.

C.6.2.4 Annual Financial Information. This section should include at least the last 3 years of financial data. This will most likely be extracted from annual financial reports or any other accounting and financial information that is available. In addition, this section may or may not provide the same level of information that is reflected in the NASA audited financial statements since the candidate organization may not be required to produce this information at this time. The section should also include budget projections along with a description of the program base and anticipated enhancements in the coming years as a result of transferring to the WCF. If the organization utilizes physical assets in production, characterize the degree to which the assets are fixed or variable. Also include the amount of cash on hand (advance funding) to fund the transition to the WCF. This information is relevant because no cash corpus was provided to NASA to fund the transition to the NASA WCF. The information should be sufficient for the evaluation team to understand the cost of operations, how the funds are spent, projected revenue, and what is planned in the coming years.

C.6.2.5 Annual Production Statistics. This section should include production data for the goods and services produced by the organization. One of the key requirements for a WCF organization is the ability to forecast production and revenue in order to set pricing and size production capacity. The study team should spend an appropriate amount of time developing these statistics and the collection methodology to ensure the organization can adequately meet this requirement.

C.6.2.6 Rationale for Inclusion in the WCF. This section contains the fundamental reasons why the organization is a good fit for the WCF. It should factor in all the qualitative and quantitative benefits the organization and NASA will gain from transferring to the WCF. It should include a characterization of the improvements in cost, quality, and cycle time in meeting customer demands. It should also include a discussion of the capital improvements or enhancements that will be funded once the organization is admitted to the WCF. It should include a description of how the organization meets the following selection criteria:

a. Must possess the capability to produce one or more goods or services that are needed on a recurring and relatively predictable basis within NASA and/or other federal government entities or other sources.

b. Operation as a NASA WCF business area will result in a better product/service and/or decreased costs to the federal government.

c. Demand for goods or services must be from multiple customers within NASA and/or other federal government entities or other sources.

d. Must use "Full Cost" methodology to identify costs of goods and services.

e. Must possess the capability to charge prices or rates that approximate the full costs of the provided goods and services.

C.6.2.7 Estimated Transition Costs. This section should include a complete assessment of the cost required to transition to the WCF. It should include the costs of process changes, transition planning, training, and information technology changes required to integrate operations into the WCF. The analysis should also include a time dimension to indicate when the costs will be incurred. Some costs will be one-time only (i.e. transition training), while others will be recurring (i.e. software and hardware maintenance). This section provides data for the first half of the payback analysis. The next section, cost savings, provides the rest of the required data.

C.6.2.8 Estimated Cost Savings. This section should include an assessment of the cost savings that may be generated by the transition to the WCF. As was the case with transition costs, this information should have a time dimension to show both the immediate and recurring savings. The section should also include a description of how the savings will be generated. Recall that savings may be generated by process efficiencies, better asset leverage from economies of scale, strategic sourcing, better funds management (i.e. no end-of-year spending drills), and effective capacity management. Short and long term savings estimates should be made for all applicable mechanisms. While cost savings is not a prerequisite for inclusion in the WCF, to the extent that use of the WCF mechanism enables cost savings and process efficiencies, the business case should reflect potential savings.

C.6.2.9 Other Benefits. This section should include qualitative benefits from joining the WCF. It may also include topics that have not been addressed previously that address unique features of the organization.

C.6.2.10 Payback Analysis.

C.6.2.10.1 As mentioned earlier, in looking at the candidate organization as a commercial enterprise, sufficient payback should be generated to warrant taking on the transition costs and risks. Financial payback is constrained by projected cost savings generated by the transition to the WCF. While cost savings are not a requirement for inclusion, transition investments should be balanced with tangible benefits (whether financial or operational).

C.6.2.10.2 Payback analysis should include net cost savings projections (the difference between the cost savings and the transition costs) as well as a return on investment (ROI) and break-even analysis. ROI is defined as the profit or loss resulting from an investment transaction, usually expressed as an annual percentage return. ROI is calculated as follows:

| ROI = | Net Cost Savings |

| ---------------------------- | |

| Net Transition Costs |

Figure A-2, ROI Calculation

C.6.2.11 ROI is a reasonable indicator of the return per unit of investment. In developing the financial analysis for the business case, the study team may want to include other financial analysis techniques such as:

a. Net Present Value (NPV). An approach used in capital budgeting where the present value of cash inflow is subtracted from the present value of cash outflows. NPV compares the value of a dollar today versus the value of that same dollar in the future, after taking inflation and return into account. If the NPV of a prospective project is positive, then it should be accepted. However, if it is negative, then the project probably should be rejected because cash flows are negative.

b. Return on Assets (ROA). A useful indicator of how profitable a business is relative to its total assets. ROA is calculated by dividing annual earnings by total assets. ROA is displayed as a percentage. Sometimes this is referred to as Return on Investment.

c. Discounted Cash Flow (DCF). A method used to estimate the attractiveness of an investment opportunity. DCF is calculated by estimating cash flows into the future and discounting them back at an appropriate interest rate.

d. Internal Rate of Return (IRR). The IRR for an investment is the discount rate for which the total present value of future cash flows equals the cost of the investment.

C.6.2.12 Each of these metrics has strengths and weaknesses in supporting investment decisions. The key is to select the technique(s) that most accurately portray the financial data.

C.6.2.13 In addition, to ROI, the business case document should contain a break-even analysis. Break-even analysis calculates the length of time required to recover the cost of an investment (referred to as the payback period). Payback period is usually measured in years. Obviously, the shorter the payback period, the more attractive the investment is.

C.6.2.14 Risk Assessment. The risk assessment should include an honest analysis of the transition risks associated with the transition to the WCF. This should include a description of the risks, a determination of the probability that key planning assumptions will not occur as planned, and a mitigation strategy for addressing each shortcoming. Typical risks include:

a. Longer than expected payback period.

b. Longer than expected transition time to new organization or only partial integration (only some Centers participate).

c. Lower than predicted procurement savings from strategic sourcing.

d. Higher than estimated transition costs.

C.6.2.15 Conclusion. This section should include a concluding argument for transitioning the organization to the WCF. No new information should be included here, but rather the section should summarize the case made through the whole document, emphasizing the key points.

C.6.3 Optional Material. In addition, to the material listed as required, the study team may want to include other information that provides a comprehensive view of the benefits and costs of transitioning to the WCF. This is information that will be useful in determining if the candidate organization should be selected and in understanding if it is prepared for the transition to the WCF. As with all financial analysis, the key is to be balanced and complete. Candidates should not try to sway the decision by providing only positive information. Again, one of the reasons the business case is developed is to ensure the organization can be financially and operationally viable in the WCF environment. The fact that an organization is not admitted into the WCF is not a negative reflection of the organization, but rather a function of the unique nature of operating in a WCF environment.

| TOC | ChangeHistory | Preface | Chapter1 | Chapter2 | Chapter3 | AppendixA | AppendixB | AppendixC | ALL | |

| | NODIS Library | Financial Management(9000s) | Search | |

This document does not bind the public, except as authorized by law or as incorporated into a contract. This document is uncontrolled when printed. Check the NASA Online Directives Information System (NODIS) Library to verify that this is the correct version before use: https://nodis3.gsfc.nasa.gov.